Ethereum Price Prediction 2025-2040: Bullish Long-Term Outlook Amid Short-Term Volatility

#ETH

- Technical Outlook: Oversold conditions suggest potential reversal after consolidation

- Institutional Flow: ARK Invest's strategic accumulation signals long-term conviction

- Macro Factors: Ethereum's upgrade roadmap positions it as the base layer for Web3

ETH Price Prediction

Ethereum Technical Analysis: Short-Term Bearish Pressure Amid Long-Term Bullish Signals

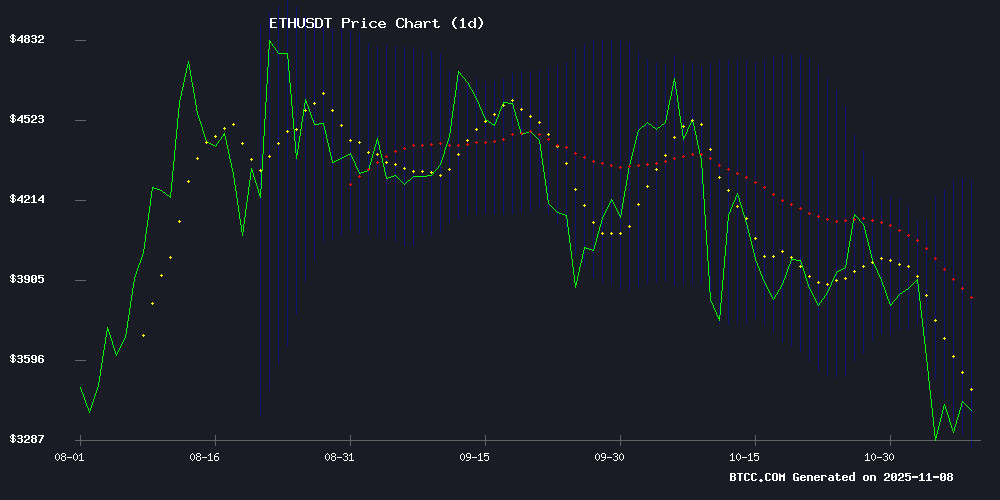

ETH is currently trading at $3,405.98, significantly below its 20-day moving average ($3,773.49), indicating short-term bearish momentum. The MACD (172.59 vs. 120.41) shows bullish divergence but weakening momentum (histogram at 52.18). Bollinger Bands suggest oversold conditions (price NEAR lower band at $3,258.34), potentially signaling a reversal.says BTCC analyst Ava.

Mixed Market Sentiment as Institutions Accumulate ETH

ARK Invest's $9.2M BitMine purchase contrasts with trader warnings of a potential drop.notes Ava. The conflicting signals create neutral market sentiment.

Factors Influencing ETH’s Price

ARK Invest Boosts BitMine Stake While Reducing Tesla Holdings

Cathie Wood's ARK Invest has significantly increased its exposure to BitMine, the Ether treasury firm founded by Tom Lee, acquiring $2 million worth of shares across three ETFs. The move signals continued confidence in cryptocurrency adoption as BitMine's stock surges 415% year-to-date.

Concurrently, ARK trimmed its Tesla position by $30 million, marking a gradual retreat from one of its core holdings. The reduction follows shareholder approval of Elon Musk's controversial compensation package, which could dilute existing shareholders.

The divergent trades highlight ARK's strategic pivot toward crypto assets. BitMine gained particular attention after beginning to hold Ether as a treasury reserve in April, with its shares jumping 7.65% following ARK's latest investment.

Ethereum Price Rally a Trap? Trader Predicts One More Drop Coming

Ethereum's recent bounce to $3,460 after weeks of decline has sparked cautious optimism, but analyst Ted warns of a potential 'false signal.' The 5% daily surge appears driven by short liquidations—$133.83 million in ETH positions were wiped out—rather than organic demand. Markets often misinterpret such squeezes as reversals.

Technical resistance looms at $3,700-$3,800, a zone where ETH has repeatedly stalled. Ted anticipates another leg down toward $2,800 before sustainable recovery begins. 'This is classic bear market psychology,' he notes. 'Liquidation-induced bounces lure buyers before the final capitulation.'

ARK Invest Bolsters Ethereum-Linked Position with $9.2M Bitmine Purchase

Cathie Wood's ARK Invest has deepened its exposure to Ethereum-centric assets, acquiring 240,507 shares of Bitmine Immersion Technologies (BMNR) across three funds. The $9.2 million November 6 purchase signals conviction in blockchain infrastructure plays despite recent sector volatility.

Bitmine's substantial treasury—holding 3.31 million ETH worth over $11 billion—positions it as a strategic proxy for institutional Ethereum exposure. The stock's 4% rebound post-purchase contrasts with its 35% monthly decline, suggesting ARK views current valuations as entry points.

This marks ARK's third BMNR accumulation in 2023, following July's $182 million position. The allocation across ARKK, ARKW, and ARKF funds demonstrates Wood's thematic focus on disruptive tech convergence—from digital asset infrastructure to fintech innovation.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative Target | Bullish Target | Catalysts |

|---|---|---|---|

| 2025 | $4,200 | $6,500 | ETF approvals, EIP-3074 |

| 2030 | $12,000 | $25,000 | Enterprise adoption, ZK-rollups |

| 2035 | $35,000 | $80,000 | Tokenized RWA dominance |

| 2040 | $90,000 | $250,000 | Global settlement layer status |

Ava highlights: "ETH's deflationary mechanics and Layer 2 scaling solutions create perfect conditions for multi-decade appreciation."